How Much Does The Average American Pay In Taxes Annually?

The answer is – probably a lot more than you realize. That’s what this article is about.

In ancient times records show that when the people had to pay half their income in taxes they considered themselves in very uncomfortable circumstances.

Early in my life I bought a Mexican restaurant and was able to keep things going for 3 years. What do you suppose rooted me out of business? Yep, taxes – as in more taxes than I could pay. In looking back I now realize if it hadn’t been for the parasitic taxes and fees that I had to pay I would still be in business today.

Since those days in the early 1980’s things have only got worse, meaning more taxes and fees to pay for individuals and businesses. I decided to stop the world and take stock of exactly where we stand right now in paying taxes.

On Average What Percentage Of Our Income Goes To Taxes?

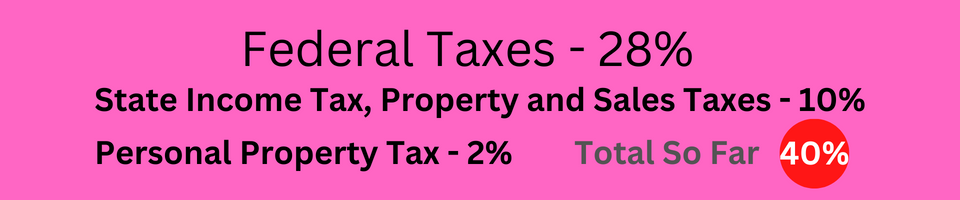

Federal Taxes – let’s start with the most obvious tax we pay, taxes to the federal government.

In 2018 the average worker contributed about $15,314.42 to the federal government, having a median yearly salary of $53,924. This includes these three taxes: income, Social Security, and Medicare and amounts to 28.4% of their income. (thebalancemoney.com)

State Income Tax, Property and Sales Taxes

Most state governments levy an income tax. And many state and local governments also levy property and sales taxes. All told, the typical American pays just over $5,000 a year in state and local taxes, equal to 9.8% of their estimated annual income. ( published on USA Today)

Personal Property Tax

Most state and local governments assess personal property taxes, which is different from the property tax listed already. The above property tax is paid by those who own real property, like land and a house. Renters pay this also since it’s included in their rent. Personal property tax is about the other things you own, like cars, boats, motorcycles, rv’s and related holdings.

Here’s a list of taxes you probably pay on personal property:

- Sales tax

- Property tax as assessed

- Vehicle registration tax

- Driver’s license fees

- Gasoline tax

- Highway toll fees

- Inspection fees

- License plate fees

- Parking meter fees

- Biodiesel fuel tax

- RV tax

- Tire tax

These are the main taxes most people are familiar with and pay. Maybe more or less for you.

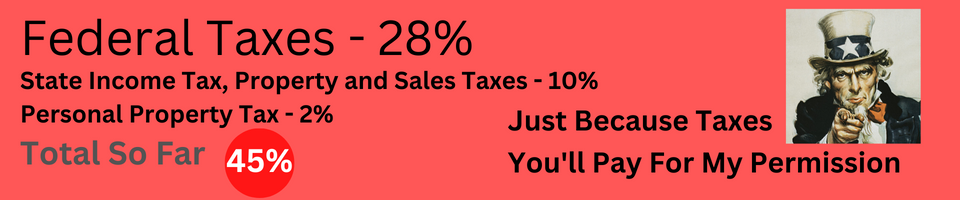

Just Because You Are Alive Taxes

We pay taxes on things that we like to do, just because our government can. Here’s a few:

- Tobacco tax

- Liquor tax

- Hunting license fees

- Fishing license fees

- Marriage license fees

- Dog license tax

- Gun ownership fees

- Library card fees

- Sports stadium tax

- State and Federal Park entrance fees

- Tanning tax

That’s quite a few of the most popular taxes and fees, just because. I’m sure there are more

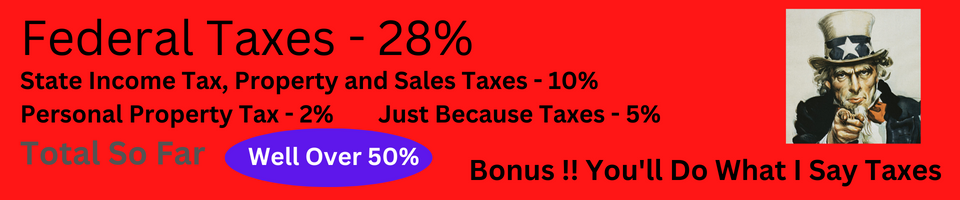

Because Someone Believes They’re The Boss Taxes

It seems lawmakers are always looking for another honey hole to tax. Here’s a few examples:

- Business permit fees – if you dare start a business you owe us

- Estate tax – If you die you better pay taxes on your way out

- Inheritance tax – a tax imposed on someone who inherits property or money. That’s right, they paid for it on the way out and you will pay again because you got it ( and we don’t believe you deserve it)

- Gift tax – tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. Don’t you even try to slide one past us, you don’t have any right to “give it away”.

- Hotel tax – you are travelling? Then pay up.

- Import taxes – tax levied by governments on the value including freight and insurance of imported products. Who pays the tax ultimately? We do. Who gets the taxes paid? Good question, but we don’t.

- IRS penalty and interest charge – Oh, you couldn’t pay it on time? Well, we will put a tax on a tax for you.

- Luxury tax – a sales tax or surcharge levied only on certain products or services that are deemed non-essential or accessible only to the super-wealthy. No one should have that much money, give us a nice chunk of that.

- Passport fees – travelling abroad? Pay!

- Air Transportation tax – Every traveler pays a 7.5 percent transportation excise tax. It is a tax paid by travelers, not the airlines.

- Self Employment tax – If you don’t want to hire employees, then there must be a tax for you.

Don’t worry, as new opportunities come along you can depend on us to tax them.

Inflation – A Wicked Tax On The Poor And Middle Class

Inflation is not a natural occurrence, but it’s been a part of our life non the less. If you want to understand inflation fully there are plenty of resources out there to study. But here’s the concept in a nutshell. Uncle Sam doesn’t have real money ( gold) to do everything he wants so he just creates it out of thin air ( currency).

If Uncle Sam can’t afford everything he wants he has two options to raise the funds. He can raise taxes or borrow the money. As much of a tax burden as we already have there’s not much chance he can raise them more without a revolt. If he borrows the money he doesn’t have to ask permission from us, the tax payer. He knows we’ll foot the bill later, after he has spent the cash.

So, more currency in circulation with the same amount of stuff to buy = higher prices. Does this affect the rich? No, not really, they can just move money around. The poor and middle class ultimately pay this tax. They didn’t have anything to do with creating the problem but they will pay to fix it.

Inflation results in a way for us to pay taxes without being asked. The more the government inflates the currency supply, the more we pay for goods. No way around it.

So when is “enough is enough” of the foolishness? I can’t say right now but the trajectory suggests we’ll soon find out.

Well written and inspiring! Keep up the great work.

Thanks for sharing! I learned something new today.

Great insights! This really gave me a new perspective. Thanks for sharing.

Your prose flows like a quiet river, carrying the reader gently along. It invites contemplation and reflection, each paragraph a ripple that lingers beyond the page.

weed edibles usa shipping discreet secure

unlocker.ai – The Ultimate AI Tool for Bypassing Restrictions and Unlocking Content Seamlessly!

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

**aquasculpt**

aquasculpt is a premium metabolism-support supplement thoughtfully developed to help promote efficient fat utilization and steadier daily energy.

**herpafend reviews**

Herpafend is a natural wellness formula developed for individuals experiencing symptoms related to the herpes simplex virus. It is designed to help reduce the intensity and frequency of flare-ups while supporting the bodys immune defenses.

**mounja boost official**

MounjaBoost is a next-generation, plant-based supplement created to support metabolic activity, encourage natural fat utilization, and elevate daily energywithout extreme dieting or exhausting workout routines.

**prodentim reviews**

ProDentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth, comfortable gums, and reliably fresh breath

**men balance pro**

MEN Balance Pro is a high-quality dietary supplement developed with research-informed support to help men maintain healthy prostate function.

**prostafense official**

ProstAfense is a premium, doctor-crafted supplement formulated to maintain optimal prostate function, enhance urinary performance, and support overall male wellness.

**neuro sharp**

Neuro Sharp is an advanced cognitive support formula designed to help you stay mentally sharp, focused, and confident throughout your day.

**boostaro**

Boostaro is a purpose-built wellness formula created for men who want to strengthen vitality, confidence, and everyday performance.

**backbiome**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.